The addition of Nvidia to the Dow Jones Industrial Average is a notable milestone, suggesting a more stable outlook for the AI chipmaker in its continued rise and increasing prominence in the tech sector.

The artificial intelligence leader Nvidia is set to replace Intel in the Dow Jones Industrial Average (DJIA), as announced in a press release by S&P Global on 1 November.

This adjustment, taking effect before trading opens on 8 November, will also see Dow Inc. replaced by The Sherwin-Williams Co. in the index.

The DJIA, the oldest stock index in the world and one of Wall Street’s three major benchmarks, stated that the update aims to ensure “a more representative exposure to the semiconductors industry and the materials sector, respectively”.

The Dow Jones Industrial Average tracks 30 large publicly traded companies across various sectors. Unlike indices weighted by market capitalisation, such as the S&P 500, the DJIA is price-weighted, meaning companies with higher stock prices have a greater influence, regardless of their overall market value.

Nvidia’s recent 10-for-1 stock split, aimed at increasing accessibility for investors, has also facilitated its inclusion by reducing its influence on the index’s movements.

The addition of Nvidia to the Dow is a notable milestone, suggesting a more stable outlook for the company in its continued rise. The DJIA often includes blue-chip firms that are well-established, financially stable, and significant players within their industries, which aligns with Nvidia’s profile. Nevertheless, the inclusion may not lead to a substantial buying surge, as most passive investment funds focus on broader indices, like the S&P 500.

Meanwhile, Intel, one of the world’s most renowned technology companies, providing central processing units (CPUs) for personal computers, has been facing growth challenges. Lagging behind competitors such as Nvidia, Broadcom, and Taiwan Semiconductor Manufacturing Co. Ltd. in the AI chip sector, Intel has seen a drastic fall in valuation, losing over half of its market capitalisation this year as its share price dropped to a 10-year low.

The company has announced cost-cutting measures, including staff reductions and facility closures, and has drawn interest from rivals who may consider acquiring parts or all of its operations.

Nvidia May Surpass Apple Again in Market Valuation

Nvidia’s inclusion in the Dow further underscores its meteoric rise in market valuation amid the AI boom.

In June, Nvidia briefly overtook Apple as the world’s most valuable company after securing a 20% weighting in the Technology Select Sector SPDR Fund (XLK) within the S&P 500. Nvidia’s market capitalisation currently stands at $3.34tn (€3.07tn), trailing Apple by a modest $20bn, or about 6%.

Nvidia has benefitted from surging demand in AI technology, with its shares soaring 174% year-to-date and 910% over the past two years.

Nvidia’s exceptional stock performance is supported by robust revenue growth, which surged by 270% over the first two quarters of its 2025 fiscal year.

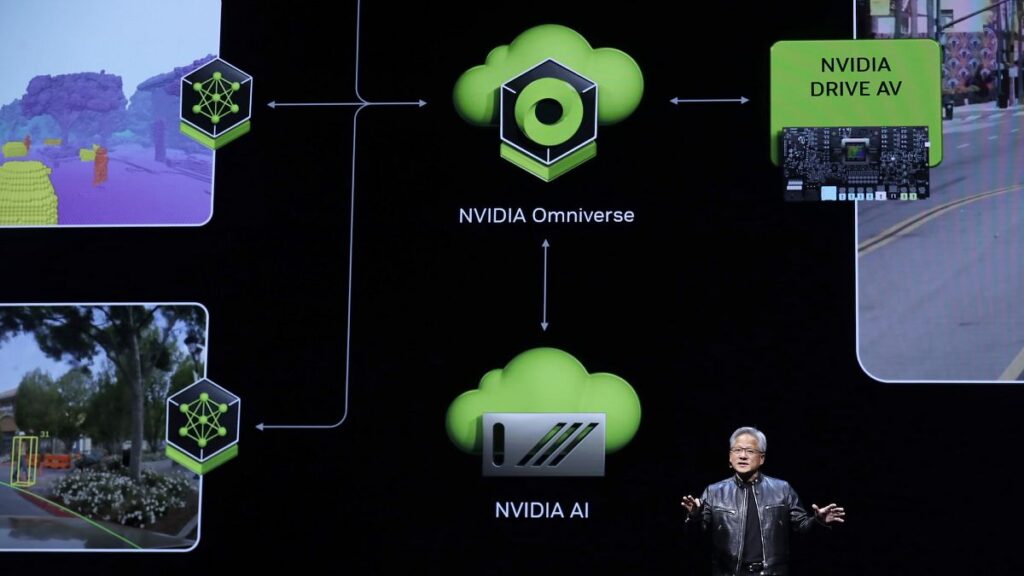

Its new Blackwell AI chips have been so highly sought after that production capacity is reportedly booked out for a full year, according to analysts from Morgan Stanley. Nvidia’s CEO, Jensen Huang, recently confirmed that Blackwell production is at full capacity, describing demand as “insane”. The forthcoming fiscal third-quarter earnings report for 2025, scheduled for next month, will likely attract close investor scrutiny.

Conversely, Apple’s momentum slowed following its September-quarter earnings results last week.

Sales in China have continued to decline amid intensified competition from Chinese rivals, and its AI capabilities, branded “Apple Intelligence”, failed to excite investors. Apple appears to be lagging behind other tech giants in the race to capitalise on AI innovation, especially compared with Nvidia’s rapid ascent.

Read the full article here